A Significant Milestone to Achieve Transparency of Climate Risk

In a long-awaited climate ruling, the Securities and Exchange Commission (SEC) ruled 3-2 in favor of the climate-related disclosures on March 6, 2024. The ruling requires designated reporting companies to begin reporting Scope 1 and Scope 2 Greenhouse Gas (GHG) emissions and material climate-related risks related to business strategy, operations or financial condition.

While the ruling is scaled back from the version proposed in 2022, and removes Scope 3 emissions from the reporting requirement, this represents a significant climate-related milestone in helping to achieve greater transparency around climate risk.

Timeline for Filing Companies (based on a phased-in approach):

This landmark ruling provides a baseline for U.S. companies for climate reporting and provides structure that is broadly aligned with:

- Voluntarily reporting frameworks

- European Union climate disclosure directives

- State-level reporting requirements, such as California’s requirements

Not sure what all of this means? TRC has a seasoned team of industry experts and can offer strategic advice and assistance to your organization in navigating climate-related compliance readiness. We provide a practical, actionable approach to required reporting, and solutions to mitigate climate risk.

| Company Type | Disclosure (Financial Statement & Audit)

Fiscal Year Beginning |

GHG Emissions/Assurance

(Phased in from Scope 1,2 – Limited Assurance to Reasonable Assurance) |

Electronic Tagging of Financial Statements |

| Large Accelerated Filers | 2025 | 2026 – 2029 – 2033 | 2026 |

| Accelerated Filers (except for Smaller Reporting Companies (SRCs) and Emerging Growth Companies (EGCs) | 2026 | 2028 – 2029 – 2033 | 2026 |

| Smaller Reporting Companies (SRCs), Emerging Growth Companies (EGCs) and Non-Accelerated Filers (NAFs) | 2027 | N/A | 2027 |

About Our Authors

Megahan Peterson is an Associate Director in TRC’s ESG Advisory Services group that provides services to both corporate and financial services clients. She has experience integrating options for corporate and financial managers for investment portfolios and operations strategies.

Hillary Rupert, Senior Director, is a strategic sustainability professional who develops and drives mission-critical programs, adding significant value as a thought leader in sustainable systems for more than a decade. She fosters valued partnerships to advance organizational objectives relating to environmental and social initiatives.

If you would like to learn more about TRC’s services relevant to the SEC disclosure rule, please contact Megahan at mepeterson@trccompanies.com or Hillary at hrupert@trccompanies.com.

Sharing Our Perspectives

Our practitioners share their insights and perspectives on the trends and challenges shaping the market.

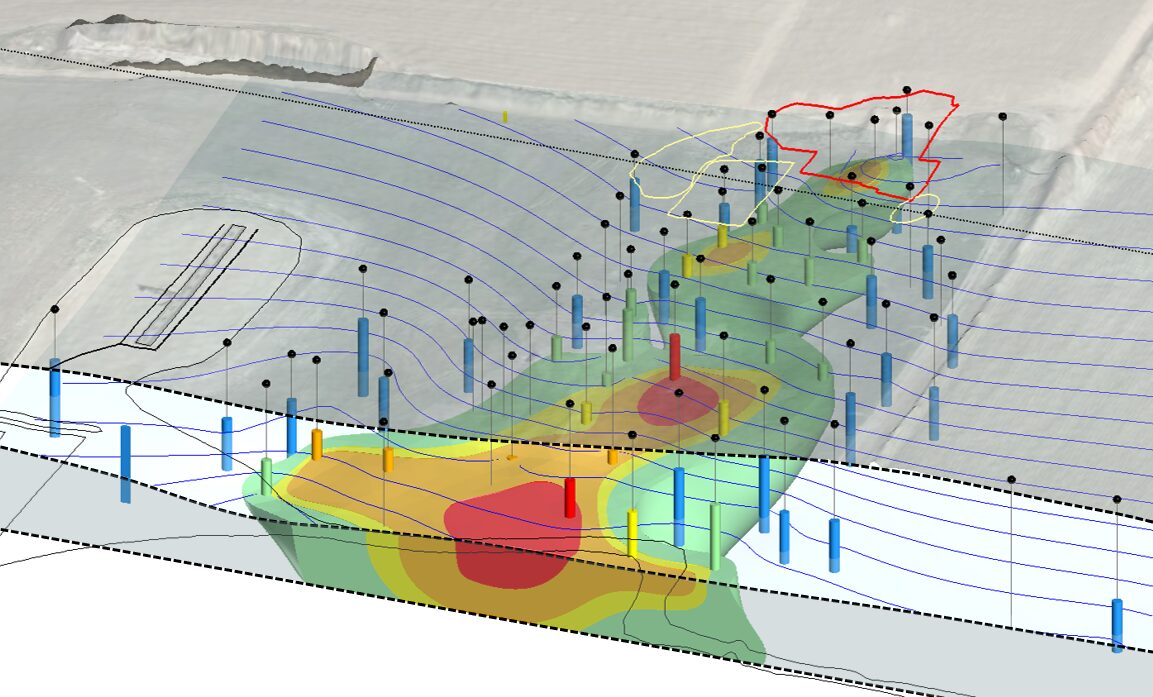

Development and Types of Conceptual Site Models (CSMs)

March 15, 2025

There are vast resources, including publications and guidance documents on the topic of Conceptual Site Models (CSMs), and the term “CSM” can mean many different things to different people depending on their technical area of expertise and their expectation about the goal or purpose of the subject CSM

Hydrogen Hub Funding Provisions

March 26, 2024

TRC’s panel of practitioners discuss the Hydrogen Hub (H2Hub) funding provisions of the Bipartisan Infrastructure Bill (BIL).

U.S. EPA’s EJScreen Evolves as the Agency Advances Environmental Justice

August 21, 2023

EJScreen is currently at the forefront of federal efforts to identify potential disproportionate environmental burdens and communities with potential environmental justice (EJ) concerns.

U.S. EPA and Army Corps of Engineers to Develop Revised Rule to Define “Waters of the United States”

August 8, 2023

The US EPA and Army Corps of Engineering are redefining “Waters of the United States”.

Regulators Update Design Storm Rainfall Depths in Response to Climate Science Projections and Recent Storm Data

August 3, 2023

Regulators are responding to anticipated increases in extreme rainfall events by updating design storm rainfall depth regulations.

EPA Issues Clarification of Free Product Removal Requirements

June 20, 2023

EPA recently clarified requirements for LNAPL recovery and remediation.

New Executive Order 14096 Broadens Environmental Justice Initiatives

May 9, 2023

Executive Order 14096, Revitalizing Our Nation’s Commitment to Environmental Justice for All, seeks to deepen the Biden administration’s “whole-of-government” approach to environmental justice (EJ) by fully integrating the consideration of unserved and overburdened communities and populations into all aspects of federal agency planning and delivery of services.

Proactive Enforcement is Key in the EPA FY2022-2026 Strategy

October 19, 2022

A core element of the EPA FY2022-2026 Strategic Plan focuses on environmental compliance.

Preparing for EPA Inspections in Environmental Justice Communities

October 4, 2022

The EPA Office of Enforcement and Compliance Assurance Have Expanded Goals to Strengthen Enforcement and Protections Within EJ Communities

New National Emerging Contaminants Research Initiative

September 12, 2022

The Executive Office of the President of the United States announced a National Emerging Contaminant Research Initiative

Locana Awarded Wildlife Habitat Analysis Task Order For The Bureau Of Land Management

April 27, 2022

Locana, a leading geographic data and technology company, has won a 10-year National Geospatial Data and Technology Support Services contract for the U.S. Bureau of Land Management (BLM).

TRC Acquires New Jersey’s Clean Energy Program Contract and Assumes Program Administrator Role

January 17, 2021

NEW BRUNSWICK, NJ and LOWELL, MA. – Jan. 17, 2017 – TRC Companies Inc., a recognized leader in engineering, environmental consulting and construction-management services, today announced it has acquired the contract to serve as Program Administrator of New Jersey’s Clean Energy Program™ (NJCEP), which has provided more than $300 million annually in support to homeowners, businesses…

Ecological Risk of PFAS from AFFF-Impacted Sites

June 30, 2020

The facts on evaluating exposure to wildlife

Security Stew: How to Follow the Federal Regulatory Recipe for Safe Chemical Storage

September 19, 2017

Three different federal agencies regulate the storage of chemicals at facilities in the United States – and each for different reasons. Learn about the various rules from the alphabet soup of agencies (DHS, EPA and OSHA) involved and how to keep your business compliant.

TRC and partners win $1 million grant for engineering innovative New York microgrid

April 20, 2017

TRC is proud to support Huntington, NY bolster power reliability and climate-change resiliency with a sophisticated new “community microgrid’’ combining solar energy, a fuel cell, biogas and traditional natural gas to deliver electricity and heat to local customers and institutions.

EPA to Include CERCLA Sites and RCRA Facilities in Site Remediation NESHAP

June 23, 2016

EPA has published a proposed rule that would extend the requirements of the Site Remediation National Emission Standards for Hazardous Air Pollutants (NESHAP) regulations to previously exempt soil and groundwater remediation activities under CERCLA and RCRA.

Manchester Moves Legacy Sites

April 9, 2014

The City of Manchester, NH continues to transform blighted areas of the City into community-based redevelopment projects supported by EPA’s Brownfields Program to improve the environment and public health and expand opportunities for neighborhood and economic development.

Megahan Peterson

Megahan Peterson is an Associate Director in TRC’s ESG Advisory Services group that provides services to both corporate and financial services clients. She has experience integrating options for corporate and financial managers for investment portfolios and operations strategies. Contact her at mepeterson@trccompanies.com.