Deal marks successful exit for New Mountain Capital

WINDSOR, Conn., NEW YORK – TRC, a leading, global consulting, engineering and construction firm that provides environmentally focused and digitally powered solutions, announced today a significant growth investment from Warburg Pincus, a leading global growth investor. The strategic investment will support the continuation of the Company’s growth initiatives including scaling the Company’s compliance focused engineering and consulting services as part of broader decarbonization efforts. TRC and Warburg Pincus share a similar culture and entrepreneurial spirit, both are well positioned to, together, drive growth for their organizations. As part of this transaction, New Mountain Capital has successfully exited its investment in TRC after supporting a period of significant business building and growth investments to transform the company and position TRC for continued growth and success in the future.

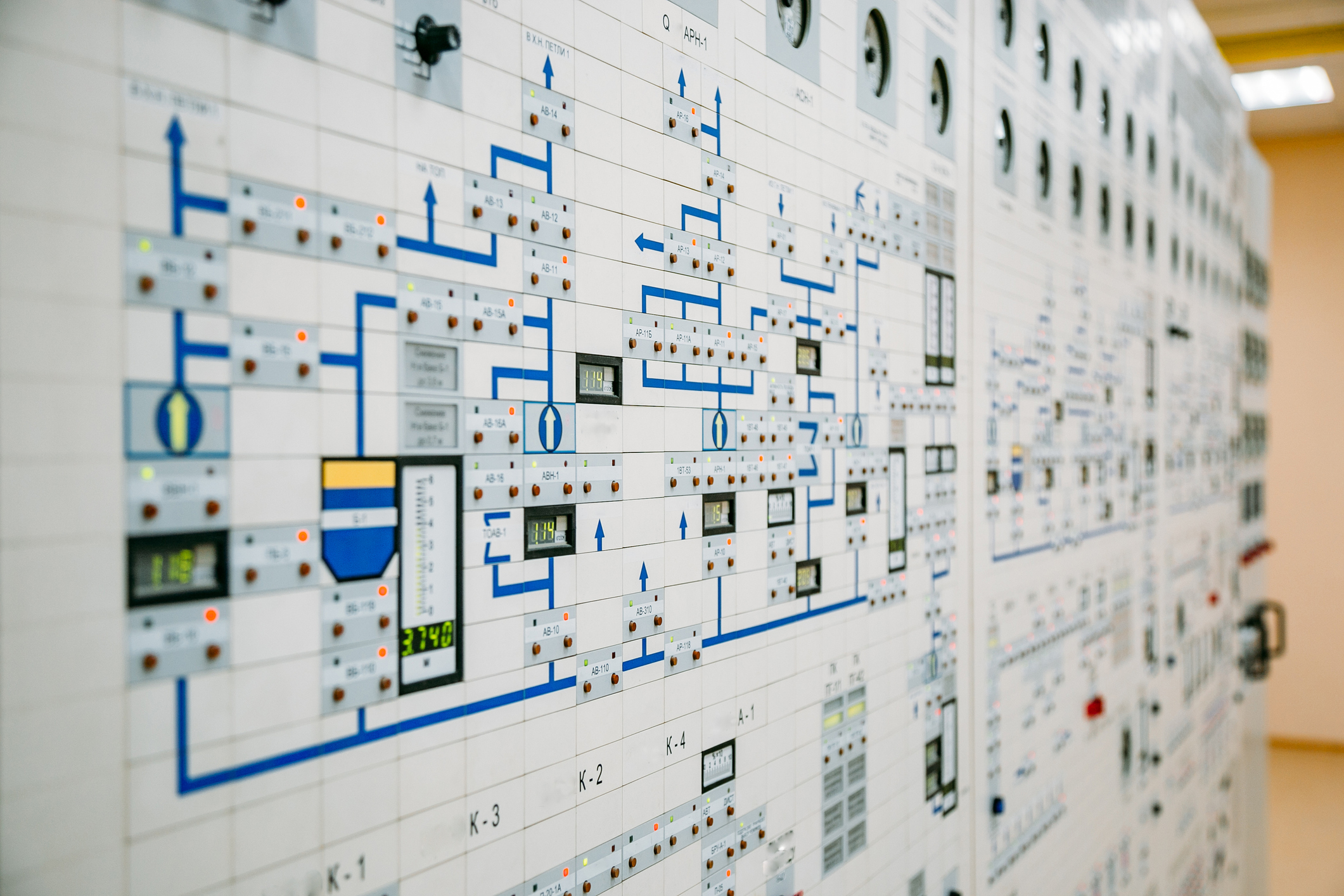

Founded in 1969, TRC has just under 6,000 highly skilled employees, as well as a strong reputation for quality and technical excellence in the industry. The Company provides technology enabled engineering, consulting and diversified environmental services to customers in the Power & Utility, Transportation, Government, Commercial and Industrial end markets. While serving a diversified client base, the Company has focused its efforts on building a differentiated position in the power and utility market. TRC has built industry leading capabilities that are critical to its utility customers, from the design and commissioning of traditional electric grid assets to advising on emerging trends in energy efficiency, renewable transition and grid digitization. In addition, TRC provides environmental engineering and consulting services that the Company has leveraged to both cross sell to its core utility customers and enter new end markets.

“We would like to thank New Mountain Capital for their tremendous partnership and support over the past four and a half years during a formative period of growth for the company. They have helped us achieve our strategic objectives and transform the business into a leading technology-enabled solutions provider to the utility and broader environmental and infrastructure markets,” said Chris Vincze, CEO, TRC. “For our next phase, we are thrilled to partner with Warburg Pincus as we continue to drive sustainable, technology-enabled results for our clients. Like TRC, Warburg Pincus has deep experience partnering with companies to enhance and grow their business. We look forward to working with Warburg Pincus in continuing our progress in providing innovative solutions for today’s energy, environment and infrastructure challenges.”

“We are proud to have supported TRC through a transformative period of organic and acquisitive growth. The Company is well positioned for continued growth and success, and we wish Chris, the TRC leadership team and all of the Company’s employees all the best in their next chapter,” said Lars Johansson, Managing Director, New Mountain Capital.

“The growth trajectory for the utilities and environmental services market is unparalleled. TRC’s proven performance, commitment to environmentally focused solutions for its customers as well as its ability to further scale makes this an exciting opportunity for Warburg Pincus,” said Stephanie Geveda, Managing Director and Head of Business Services at Warburg Pincus. “We look forward to partnering with Chris and his talented team on TRC’s next stage of growth,” added Doug Musicaro, Principal, Warburg Pincus.

Warburg Pincus is an active investor in business services companies, with notable investments in A-LIGN, Allied Universal, ARAMARK, Certified Group, GA Foods, Hygiena, Sweeping Corporation of America, Service Logic, and Sotera. The firm has a strong track record investing in companies that are committed to the growth of ESG practices across all sectors, at a global scale. Notable investments with a match on ESG focus include Assent Compliance, FlexXray, Fortius, Monolith, PTSG, Scale Microgrid Solutions, and Sunnywell New Materials.

New Mountain Capital has been a growth investor in a number of proactively selected “defensive growth” and socially positive industries, including infrastructure services and technology.

In infrastructure, New Mountain has been a leader in energy transition and decarbonization, including Pearce Services and Qualus Power Services, as well as managing and maintaining clean water infrastructure, including Inframark and Aegion. New Mountain has a strong ESG commitment to sustainability and social responsibility and has published its annual Social Dashboard on job creation and investment metrics since 2009.

Houlihan Lokey served as lead financial advisor for TRC and New Mountain Capital, and Harris Williams and UBS served as co-advisors. Kirkland & Ellis served as legal advisor for TRC and New Mountain Capital. Cleary Gottlieb Steen & Hamilton served as legal advisor for Warburg Pincus.

About TRC Companies

Groundbreaker. Game changer. Innovator. TRC is a global firm providing environmentally focused and digitally powered solutions that address local needs. For more than 50 years, we have set the bar for clients who require consulting, construction, engineering, and management services, combining science with the latest technology to devise solutions that stand the test of time. TRC’s nearly 6,000 professionals serve a broad range of public and private clients, steering complex projects from conception to completion to help solve the toughest challenges. We break through barriers for our clients and help them follow through for sustainable results. TRC is ranked #20 on ENR’s list of the Top 500 Design Firms in the United States. Learn more at TRCcompanies.com and follow us on Twitter, LinkedIn and Facebook.

About Warburg Pincus

Warburg Pincus LLC is a leading global growth investor. The firm has more than $67 billion in private equity assets under management. The firm’s active portfolio of more than 215 companies is highly diversified by stage, sector, and geography. Warburg Pincus is an experienced partner to management teams seeking to build durable companies with sustainable value. Founded in 1966, Warburg Pincus has raised 20 private equity funds, which have invested more than $97 billion in over 960 companies in more than 40 countries. The firm is headquartered in New York with offices in Amsterdam, Beijing, Berlin, Hong Kong, Houston, London, Luxembourg, Mumbai, Mauritius, San Francisco, São Paulo, Shanghai, and Singapore. For more information please visit www.warburgpincus.com.

About New Mountain Capital

New Mountain Capital is a New York-based investment firm that emphasizes business building and growth, rather than debt, as it pursues long-term capital appreciation. The firm currently manages private equity, credit, and net lease real estate funds with over $35 billion in assets under management. New Mountain seeks out what it believes to be the highest quality leaders in carefully selected “defensive growth” industry sectors and works intensively with management to build the value of these companies. Additional information about New Mountain Capital is available at www.newmountaincapital.com.

Contact:

TRC

Mary Boucher

mboucher@trccompanies.com

Warburg Pincus

Kerrie Cohen

kerrie.cohen@warburgpincus.com

New Mountain Capital

Dana Gorman

Abernathy MacGregor

dtg@abmac.com

Achieve New

Possibilities

Partner With TRC’s Tested Practitioners